Recent Posts

Sharjah, one of the seven emirates of the United Arab Emirates, offers many business advantages,…

For a fitness center in Abu Dhabi to have the reputation of being a cheap…

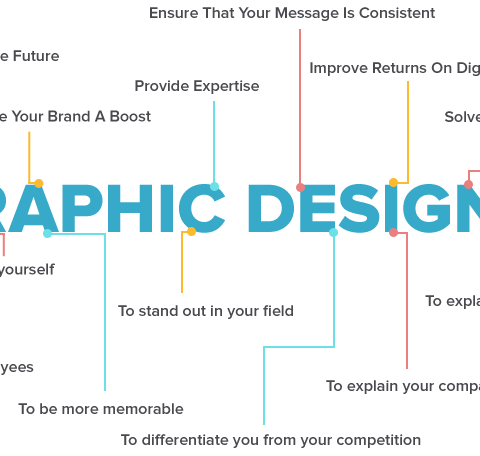

Art classes and portrait drawing in Dubai is all about expression and presentation. Sometimes graphic…

Every single thing from the environment to an individual’s age can be a cause of…

If you are looking to make a website but you are having double thoughts on…

This thing is true that a person may have a lot of items in their…

Due to increased use of machinery there arise the needs of ISO 14001 training to…

Mental disorders have become common now a days and still their number is increasing day…

Wedding themes are the hardest things to plan, people get confused when it comes it…

Home is a great blessing in this world because you can travel to whole world…